The new infrastructure normal: How the COVID crisis is affecting infrastructure spending and consumption

Jean Banko

With COVID-19 triggering a major economic downturn, and many companies struggling to stay open, GDP is falling in the United States and around the world. For businesses, that means negative pressure on financial performance, restricted cash flow, and tighter controls on discretionary spending and investment.

With COVID-19 triggering a major economic downturn, and many companies struggling to stay open, GDP is falling in the United States and around the world. For businesses, that means negative pressure on financial performance, restricted cash flow, and tighter controls on discretionary spending and investment.

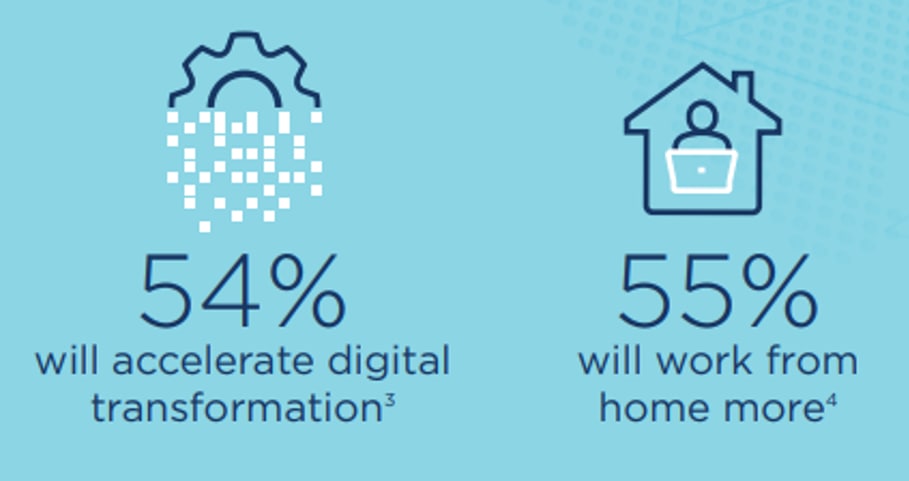

The crisis has also changed how we work, increasing multiple business trends. Mandatory shutdowns and stay-at-home requirements have increased remote work exponentially and made online videoconferencing the norm. In a recent CDX digital roundtable poll, 55% of respondents said that they would work from home more, with 54% planning to accelerate digital transformation.

Figure 1) Work and social norms are changing fast.[/caption]

Figure 1) Work and social norms are changing fast.[/caption]

Overall IT spending is down

In response to the economic slowdown and changing work patterns, companies are also cutting IT budgets and reevaluating their IT priorities. Gartner predicts an 8% decline in global IT spending in 2020 due to the impact of COVID-19. Retail, energy, transportation, and education are being hit the hardest, with a majority of companies in these industries planning to cut IT budgets by 10% or more. And across industries, amid the uncertainty and declining revenues, more than 60% of organizations plan to reevaluate current projects, reset priorities, or put new projects on hold. Figure 2) Industries cutting IT budgets by 10% or more.[/caption]

Figure 2) Industries cutting IT budgets by 10% or more.[/caption]

Flexible IT spending is up

One of the biggest trends in 2020 is a steady shift toward pay-as-you-go models, which better align expenses with usage and cash flow. Through 2020, flexible consumption models are predicted to grow 15 times faster than capital expenditure (capex) models. Even for on-premises deployments — traditionally a capital expenditure — 15% of respondents plan to use pay-per-use pricing by 2022, up from less than 1% in 2019.The bottom line: Whatever your industry, whether your organization is public or private, responding to today’s rapid changes in work and social norms demands a new level of flexibility.

Get the operational and financial flexibility you need with NetApp Keystone

The NetApp® Keystone™ portfolio gives you almost infinite flexibility in how to run, pay for, and manage your data services. Our as-a-service, opex-centric payment option is a flexible alternative to traditional capital-outlay models. And if you need to change your purchasing and operating models down the road? You can do that, too — without switching technologies.NetApp Keystone Flex Subscription gives you all the operational and financial flexibility you need for your on-premises storage.

- Pay for performance. Storage service tiers based on IOPS and latency, to meet various workload needs.

- Pay for use. Predictable billing for committed capacity, pay-per-use for bursting.

- Get a bundled price. Hardware, core OS, and support at one $/TiB price.

- Choose a flexible term. As little as 12 months, 100TiB or more per site.

- Choose who operates. NetApp, you, or a partner.

Jean Banko

Jean Banko is Senior Manager, Portfolio Marketing at NetApp. She is responsible for advancing the company’s global marketing strategy and strengthening market recognition for NetApp’s on-premises storage-as-a-service offerings.

As a veteran of the cloud computing, AI, and storage industry, Jean has more than 25 years of experience leading and implementing successful global product marketing, product management, and marketing strategies.